Implementing omnichannel call center software can change the way insurance providers interact with clients. It helps streamline internal processes, and ultimately improve customer experience.

In this article, we’ll talk about how How Omnichannel Call Center Software can help Insurance Agencies

How Insurance Providers Can Benefit From Call Center Software

1. Unified Customer Experience

Customer demands are ever-changing and more often than not, they become more and more difficult to keep up with for a lot of businesses. Customers today expect seamless and personalized interactions across all touch points. Disjointed experiences not only frustrate customers but also hinder businesses from nurturing loyalty and trust. To address and overcome this challenge, many companies have started embracing Unified Customer Experience Management (Unified CXM). CXM has completely revolutionized how brands engage with their customers.

Related Article

2. Streamlined Interactions

With omnichannel call center software, all customer interactions are consolidated into a single, unified platform. This means that whether a customer reaches out via phone, email, chat, or social media, agents can access the entire interaction history. This consolidation reduces the need for customers to repeat themselves and allows agents to provide faster, more accurate responses.

3. Personalized Service

Leveraging customer data from previous interactions enables agents to offer personalized service. Knowing a customer’s history, preferences, and past issues allows agents to tailor their responses, improving customer satisfaction and loyalty.

4. Omnichannel Support

Customers expect seamless service regardless of the communication channel they choose. Omnichannel support ensures that transitions between different channels (e.g., from chat to phone call) are smooth and that customers don’t have to restart their queries. This consistency enhances the overall customer experience and meets modern expectations for service flexibility.

“Implementing omnichannel call center software transforms how insurance agencies operate by streamlining workflows and enhancing agent productivity. This not only boosts efficiency but also significantly improves customer satisfaction.” – Michael McGuire – Senior Contact Center Software Consultant

5. Improved Agent Productivity

Agent productivity is crucial for the efficiency of any call center, especially in the insurance industry. Omnichannel call center software enhances productivity by automating repetitive tasks, allowing agents to focus on complex customer issues. Features like call recording and real-time coaching support continuous improvement through immediate feedback and targeted training. Performance metrics and reporting tools provide insights for optimizing operations. Additionally, collaboration tools, such as internal chat systems and shared knowledge bases, enable quick access to information and peer assistance, leading to faster issue resolution and a more efficient work environment.

Related Resource

Ebook | 16 Must Have Productivity Tools for your Contact Center

6. Automated Workflows

Automation tools integrated into call center software can handle routine tasks such as data entry, follow-up reminders, and call routing. This reduces the administrative burden on agents, allowing them to focus on more complex customer issues, thus increasing productivity.

Related Article

Customer Experience Automation – Benefits and Best Practices

7. Call Recording

Call recording is an invaluable tool for training and quality assurance. By reviewing recorded calls, managers can identify areas for improvement, ensure compliance with regulations, and provide targeted feedback to agents.

Related Article

8. Real-Time Coaching and Monitoring

Supervisors can monitor calls in real-time and provide instant coaching to agents when needed. This immediate feedback helps agents correct mistakes on the spot and improve their performance over time.

Related Article

9. Reduced Costs

Implementing omnichannel call center software can lead to significant cost savings. Automated workflows and efficient call handling reduce the need for a large workforce. Additionally, improved first-call resolution rates and reduced call handling times lower operational costs. Investing in such software can be a cost-effective strategy to enhance service delivery while managing expenses.

What Providers Should Look for When Choosing a Call Center Vendor

When selecting a call center vendor, insurance providers should focus on scalability to support growth, ease of use to streamline training, and reliable customer support. It’s also essential to ensure strong security measures and compliance with industry regulations to protect sensitive data. Prioritizing these factors will help in choosing a vendor that enhances operational efficiency and delivers excellent customer service.

“Our call center solutions are designed to empower agents with the tools they need to deliver exceptional service. By automating routine tasks and providing real-time coaching, we enable agents to focus on what matters most – resolving customer issues quickly and effectively.”- Christian Montes Executive Vice President Client Operations

Features

- Interactive Voice Response (IVR): An advanced IVR system can efficiently direct calls to the appropriate departments or agents, reducing wait times and improving customer satisfaction.

- Omnichannel Support: Ensure the software supports multiple channels, including email, SMS, and online chat, to provide a seamless customer experience.

- Advanced Call Management: Features such as call queuing, call forwarding, and conferencing are essential for effective call management.

- Smart Call Routing: Auto-attendants and skills-based routing ensure that calls are directed to the most qualified agents, enhancing service quality.

- CRM System Integrations: Integration with CRM systems allows agents to access customer information quickly, facilitating personalized and efficient service.

- Voice, Video, Email, Web Chat, and SMS Messaging Support: Comprehensive channel support ensures that all customer communication preferences are met.

Scalability and Flexibility

Choose the solution that will grow with your business as needs change. Such flexible software can scale not only to volumes but also to evolving customer expectations. This is very critical in an insurance provider whose call volumes increase during any special season or when there is a need to scale operations rapidly. Such a flexible and scalable solution guarantees that your insurance agency will scale up or down with your business, offering service quality without disruption.

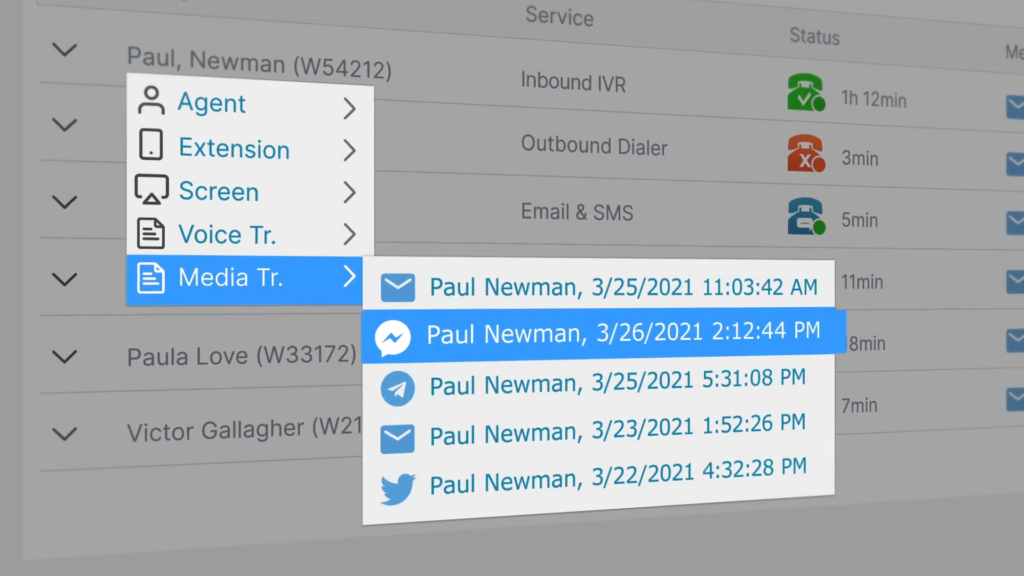

Nobelbiz OMNI+ Supervisor Dashboard

Reporting and Analytics

Next-gen reporting and analytics provide insight into performance and problems in order to make data-driven decisions. Advanced reporting and analytics provide insights into relevant and actionable key metrics related to call volume, average handling time, and customer satisfaction. This sort of insight will help managers fine-tune operations for better performance of the agents and hence an improved customer experience. Robust reporting tools support proactive issue identification and resolution to ensure continuous improvement.

Related Article

Ease of Use

The user-friendly software reduces training time and improves agent productivity. This factor is all about intuitive interface and well-organized systems. Agents should be able to learn and use the software with ease, using very minimal training that reduces downtime and increases efficiency. The easiest system to use reduces the chances of errors, hence more attention is given to good customer service.

Support and Training

Reliable vendor support and broad-ranging training programs help your team get the most out of the software while quickly troubleshooting any problems. Ongoing support from the vendor is instrumental in the solution of technical problems, performing updates, and even deriving full value from new features.

Comprehensive training programs make it possible for agents and managers to reap the full benefits of the software by first gaining a complete understanding of it, thus improving performance to deliver a better overall customer experience.

Security and Compliance

Your call center software should be able to adhere to industry regulations, include enhanced security features that can protect sensitive customer information. This means a lot to the insurance industry, where the handling of personal data and financial information goes on almost daily.

Ensure that you settle for software that has the following: end-to-end encryption, secure access controls, periodic security audits, and compliance with these standards and regulations, very vital in keeping off legal issues and maintaining customers’ trust.

Related Article

Brayan Carpio

Insurance Providers Count on NobelBiz for Their Call Center Solutions

NobelBiz offers industry-leading call center solutions designed to meet the unique needs of insurance providers. Our omnichannel software ensures a unified customer experience, enhances agent productivity, and provides the tools necessary for data-driven decision-making.

NobelBiz Omni+ offers:

- Unified Communication Channels: Integrate voice, SMS, email, and social media for a seamless customer experience.

- Advanced Analytics: Gain insights into performance and customer behavior to refine strategies.

- Enhanced Reporting: Access detailed reports to track KPIs and measure success.

Contact us today to learn how our solutions can transform your insurance agency operations.

Reaching your outbound sales dialing targets requires a combination of the right tools, strategies, and training. NobelBiz offers a comprehensive suite of solutions designed to help you optimize your dialing efforts, personalize your outreach, and enhance your overall sales performance. By leveraging these strategies, you can increase your contact rates, improve engagement, and ultimately, achieve your sales goals.

Michael McGuire is a contact center industry expert with almost two decades of experience in the space. His experience includes roles as Director of Contact Center Digital Transformation at NobelBiz, and as Director of Operations at FLS Connect, managing multiple call centers. As President of Anomaly Squared and Targeted Metrics, Michael successfully transitioned companies into remote operations and significantly boosted revenues. With a strong background in customer service, leadership, strategic planning, and operations management, Michael excels in driving growth and innovation in the call center space.

Mike is also a proud Board Member for R.E.A.C.H Trade Group, promoting consumer protection and satisfaction and Co-host of the Off Skripted Podcast – a show about Life, Call Centers and everything in between.