The debt collection industry is undergoing a major shift. Traditional collection methods, such as persistent phone calls and letters, are making way for more nuanced, technology-driven, and customer-oriented strategies. This evolution reflects broader trends in consumer behavior, regulatory environments, and technological advancements.

What is a Debt Collection Agency and How does it Work?

A debt collection agency is a business that specializes in recovering unpaid debts on behalf of creditors. These agencies typically come into play when a debtor fails to pay their bills or loans within the agreed time frame, and the original creditor has been unsuccessful in their attempts to collect the amount owed.

A debt collection agency is a business that specializes in recovering unpaid debts on behalf of creditors. These agencies typically come into play when a debtor fails to pay their bills or loans within the agreed time frame, and the original creditor has been unsuccessful in their attempts to collect the amount owed.

Process of Debt Collection in an Agency

Debt Assignment or Purchase: When a creditor cannot collect outstanding debts, they may assign the debt to a collection agency. Sometimes, the agency purchases the debt at a fraction of its original value, acquiring the rights to collect the full amount.

Account Setup and Verification: Upon receiving a debt, the agency sets up an account for the debtor and verifies all the details. This includes the amount owed, the origin of the debt, and any previous collection efforts. Verification ensures that the claim is valid and that the agency has all the necessary information to proceed.

Initial Contact: The agency contacts the debtor to inform them about the debt and their intention to collect. This communication is typically via letters, emails, or phone calls, and must be done within the confines of the law to avoid harassment or undue pressure.

Debt Validation: If the debtor disputes the debt or requests proof, the agency must provide clear and comprehensive validation. This could include the original contract, statements showing the balance due, and a breakdown of fees and interest accrued.

Negotiation and Payment Arrangement: The agency attempts to negotiate with the debtor to recover the amount owed. This might involve setting up a payment plan that the debtor can afford, or negotiating a settlement for a lesser amount that the debtor agrees to pay in a lump sum.

Reporting to Credit Bureaus: If the debtor fails to respond or pay, the agency may report the delinquency to credit bureaus, which can negatively affect the debtor’s credit score and impact their ability to obtain future credit.

Legal Action: As a last resort, if negotiations fail and the debtor does not fulfill their payment obligations, the agency may pursue legal action. This involves filing a lawsuit against the debtor to obtain a judgment from the court that mandates payment.

Collection of Payments: Throughout the process, any payments collected are processed and recorded meticulously. The agency often retains a portion of the collected amount as their fee, with the remainder going back to the creditor.

Legal and Ethical Considerations

Debt collection agencies are bound by laws that protect consumers from abusive practices. In the U.S., this is governed by the Fair Debt Collection Practices Act (FDCPA), which sets guidelines on how collectors can conduct themselves, the times and methods by which they can contact debtors, and the actions they are prohibited from taking.

The effective functioning of a debt collection agency not only aids in recovering overdue payments but also ensures that the process respects the rights of all parties involved.

The Transformation of Debt Collection Agencies – Trends

As we delve deeper into discussing the evolution and transformation of debt collection agencies, it becomes clear that the future of collections industry lies in a balanced approach that leverages the latest technological innovations while maintaining a strong focus on compliance and customer service.

The Rise of Omni-Channel Communication in Collections

Consumers are accustomed to receiving seamless communication across all channels. This expectation has permeated the collections industry, leading to the adoption of omni-channel communication strategies. These omnichannel platforms facilitate a cohesive experience for debtors, which allows them to interact with collections agencies through their preferred channels, be it SMS, email, web chat, or voice calls. By meeting debtors where they are, agencies can enhance engagement and improve the likelihood of successful debt resolution.

Omni-channel communication also offers the flexibility to tailor interactions based on the nature of the debt and debtor preferences, leading to more personalized and effective collection efforts. The integration of these diverse channels into a unified platform ensures that all debtor interactions are tracked and managed cohesively, enhancing efficiency and compliance.

Embracing Automation for Enhanced Efficiency

Automation is revolutionizing the collections process, especially for low-balance accounts. Technologies like Interactive Voice Response (IVR) systems automate routine collection tasks, reducing the need for human intervention and thereby lowering operational costs. Automated reminders, payment notices, and self-service payment options empower debtors to fulfill their obligations at their convenience, fostering a sense of control and cooperation.

Automation is revolutionizing the collections process, especially for low-balance accounts. Technologies like Interactive Voice Response (IVR) systems automate routine collection tasks, reducing the need for human intervention and thereby lowering operational costs. Automated reminders, payment notices, and self-service payment options empower debtors to fulfill their obligations at their convenience, fostering a sense of control and cooperation.

This is why automation is especially transformative in contact centers. IVR systems not only handle initial debtor inquiries but also categorize calls based on urgency and complexity. This allows call center agents to focus on calls that require a high degree of human interaction, such as negotiating payment plans with high-value accounts or handling sensitive issues that require empathy and detailed knowledge of the debtor’s circumstances.

Advanced analytics and machine learning algorithms are also being integrated into call center operations to predict debtor behavior and optimize contact strategies. By analyzing past interactions and payment histories, these systems can schedule calls at times when debtors are more likely to be responsive. This targeted approach increases the chances of successful collections and enhances customer satisfaction by reducing unnecessary contact.

This shift towards automation not only streamlines operations but also reallocates valuable agent time towards more complex cases where human negotiation skills are crucial. The result is a more efficient use of resources and a higher overall success rate in debt collection.

Prioritizing Customer Service in Debt Collections

The modern debtor expects respectful and empathetic treatment, which is far different from the aggressive collection tactics of the past. Today’s collections agencies are increasingly adopting a customer service-oriented approach, focusing on assisting debtors in finding feasible solutions to their financial obligations. This approach not only improves the debtor experience but also enhances the agency’s reputation, leading to more amicable and productive interactions.

In call centers, this shift towards customer-centricity is evident through the adoption of advanced communication technologies and training programs that emphasize emotional intelligence and conflict resolution. Agents are trained not only in the legal aspects of debt collection but also in how to handle calls with compassion and understanding.

Educating debtors about their options, offering flexible repayment plans, and maintaining open lines of communication are all part of this new customer service paradigm. By treating debtors with respect and understanding, agencies can foster a cooperative environment that is conducive to debt resolution. Call centers are equipped with tools that allow agents to quickly access a debtor’s full account information, ensuring that every interaction is informed and constructive.

Moreover, many agencies are now utilizing customer relationship management (CRM) systems that integrate with call center technology to provide a seamless experience for both agents and debtors. These systems help manage debtor profiles, track all communications, and automate follow-ups, thereby ensuring consistency in customer service.

Real-time feedback mechanisms are also in place in many call centers, allowing debtors to rate their interaction immediately after a call. This feedback is invaluable for continuously improving service quality and agent performance.

By incorporating these advanced tools and training, call centers are transforming debt collection into a more positive and supportive process. The emphasis on customer service helps resolve debts more effectively by building trust and cooperation between the debtor and the agency.

Navigating Regulatory Compliance

Compliance with regulatory standards is a cornerstone of ethical debt collection practices. Regulations like the TCPA and FDCPA dictate how and when agencies can contact debtors, emphasizing the importance of respectful and non-intrusive communication.

“Compliance is not just about avoiding fines; it’s about maintaining trust with customers.”Christian Montes, Executive Vice President of Client Operations @NobelBiz

The Telephone Consumer Protection Act

TCPA addresses consumer concerns over unsolicited telemarketing communications by setting strict guidelines on the use of automated dialing systems, prerecorded messages, SMS texts, and faxes. It mandates prior express consent for such communications, upholds a National Do Not Call Registry, enforces call timing restrictions, and requires telemarketers to provide identification and opt-out options during calls. Governed by the Federal Communications Commission (FCC), the TCPA allows for significant fines and legal actions against violators, ensuring businesses balance their marketing practices with consumers’ privacy and preferences, with its provisions evolving through FCC rulings and judicial interpretations to adapt to technological advancements and changing marketing strategies.

Fair Debt Collection Practice:

The Fair Debt Collection Practices Act (FDCPA) regulates the actions of third-party debt collectors and ensures fair, ethical, and non-abusive practices in debt collection. Call centers engaged in debt collection activities must comply with FDCPA requirements, which prohibit harassment, deception, and unfair practices in debt collection. Adherence to FDCPA guidelines helps call centers maintain compliance with debt collection laws and protect consumers from abusive debt collection practices.

Adhering to these regulations will not only avoids legal repercussions but also will build trust with debtors.

Training and technology are crucial in ensuring compliance. Collections agents must be well-versed in the legal aspects of debt collection, while technology solutions can automate compliance checks and documentation, ensuring that all interactions meet regulatory standards.

Leveraging CRM Integration for Better Lead Management

The integration of Customer Relationship Management (CRM) systems with collection platforms is vital for effective lead management. CRMs serve as a centralized repository for debtor information, enabling agencies to tailor their communication strategies based on individual debtor profiles and history. This level of personalization can significantly enhance the effectiveness of collection efforts.

The integration of Customer Relationship Management (CRM) systems with collection platforms is vital for effective lead management. CRMs serve as a centralized repository for debtor information, enabling agencies to tailor their communication strategies based on individual debtor profiles and history. This level of personalization can significantly enhance the effectiveness of collection efforts.

In call centers, CRM systems are especially crucial as they allow agents to quickly access detailed debtor information during calls. This access helps agents make informed decisions about how to approach each interaction based on previous communications, payment history, and debtor preferences. Such personalized interactions are more likely to result in amicable agreements and successful debt resolution.

CRM integrations also facilitate real-time updates and information sharing, ensuring that agents have the most current data at their fingertips. This immediacy helps agents have timely and relevant interactions with debtors, which can be the difference between a resolved debt and a missed opportunity. Enhanced CRM tools also support predictive analytics, which help agents identify the best times to contact debtors, predict debtor behavior, and assess the likelihood of payment success based on historical data.

Additionally, CRM systems integrated with artificial intelligence (AI) capabilities enable call centers to automate certain processes such as initial debtor screening, risk assessment, and even some communication tasks. This allows human agents to focus on more complex cases or those requiring sensitive handling, thereby optimizing the use of human resources and improving operational efficiency.

81% of contact center executives are actively investing in AI for agent-enabling technologies. These investments aim to enhance both the agent experience and operational efficiency. Deloitte.com

Finally, CRM integration supports compliance management by ensuring that all debtor interactions are recorded and monitored. This helps in adhering to industry regulations such as the Fair Debt Collection Practices Act (FDCPA) and ensuring that all communication meets legal standards, thus protecting both the debtor’s rights and the agency’s reputation.

Through these advanced functionalities, CRM integration in call centers not only improves the efficiency and effectiveness of debt collection efforts but also enhances debtor satisfaction and loyalty, which are key to sustaining long-term business success in the competitive landscape of debt recovery.

Preparing for the Future: Advanced Technologies and Training

Emerging technologies like artificial intelligence (AI) and chatbots are going to play a significant role in the collections industry. These technologies promise to further automate the collections process, provide personalized debtor interactions, and improve collection rates.

“Embracing the future means investing in both advanced technologies and comprehensive training. Only through continuous learning can we unlock the full potential of AI and chatbots, ensuring a competitive edge in the collections industry.” – Christian Montes, Executive Vice President of Client Operations @NobelBiz

Collections agencies must invest in continuous learning and development programs to equip their staff with the knowledge and skills needed to leverage these advanced tools effectively. By staying at the forefront of technological advancements, agencies can ensure that they remain competitive and efficient in their collection efforts.

NobelBiz Omni+ Call Guard Ecosystem

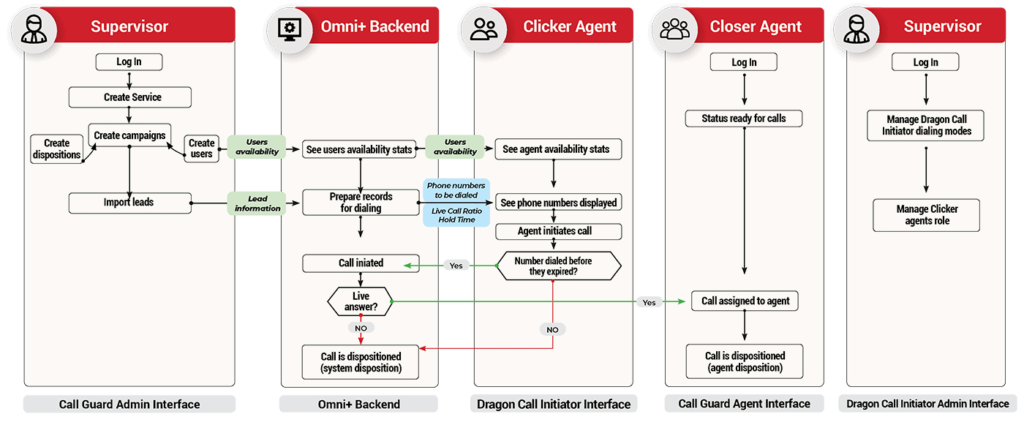

The NobelBiz Omni+ Call Guard Ecosystem offers comprehensive dialing capabilities that help increase outbound call volumes in both consent and non-consent scenarios while mitigating TCPA compliance risk.

The NobelBiz Omni+ Call Guard Ecosystem offers comprehensive dialing capabilities that help increase outbound call volumes in both consent and non-consent scenarios while mitigating TCPA compliance risk.

By offering various dialing methods, the Call Guard Ecosystem can be successfully deployed in multiple scenarios becoming increasingly popular (and even necessary) in Debt Collections, Telemarketing, Lead generation, and so on.

Brayan Carpio

“The technology aspect of NobelBiz stood out compared to the competition, and also the great team! All the way from onboarding to support to troubleshooting has been great throughout this journey!”

The debt collection industry is at a crossroads, with technology and customer service emerging as key drivers of success. By embracing omni-channel communication, automation, and advanced technologies, while maintaining a focus on customer service and regulatory compliance, collections agencies can navigate this evolving landscape effectively. The future of debt collections is not just about recovering debts; it’s about creating value for both the agency and the debtor through respectful, efficient, and innovative practices.

As the industry continues to evolve, staying informed and adaptable will be crucial for businesses and contact centers. The adoption of new technologies and approaches should be balanced with a commitment to ethical practices and compliance. In doing so, collections agencies can build sustainable business models that thrive in the changing landscape of debt recovery.

How NobelBiz Omni+ can take your Contact Center to the Next Level?

With NobelBiz Omni+ you don’t just make or take calls. You can use a sophisticated outbound dialing engine that increases your response rates, record calls to create an extensive customer history database, and move your interactions on multiple channels to cover a larger array of customer needs and demands; all while using personalized and customized scripts.

NobelBiz Omni+ is a true omnichannel contact center software solution that allows you to capture customer information, increase KPIs and maintain ASL. Seamlessly integrate proprietary or third-party CRM applications with our extensive APIs and data dictionary libraries.

Michael McGuire is a contact center industry expert with almost two decades of experience in the space. His experience includes roles as Director of Contact Center Digital Transformation at NobelBiz, and as Director of Operations at FLS Connect, managing multiple call centers. As President of Anomaly Squared and Targeted Metrics, Michael successfully transitioned companies into remote operations and significantly boosted revenues. With a strong background in customer service, leadership, strategic planning, and operations management, Michael excels in driving growth and innovation in the call center space.

Mike is also a proud Board Member for R.E.A.C.H Trade Group, promoting consumer protection and satisfaction and Co-host of the Off Skripted Podcast – a show about Life, Call Centers and everything in between.