Call centers play a crucial role in customer service and sales operations. However, in the middle the hustle and bustle of daily operations, it’s essential for call centers to prioritize compliance with various laws and regulations. Failure to do so can lead to severe consequences, including serious fines, legal actions, and reputational damage.

In this comprehensive article, we delve into the details of call center compliance, exploring its significance, the laws and regulations governing it, common mistakes to avoid, and best practices for ensuring adherence.

What is Call Center Compliance and Why is it Important?

Call center compliance refers to the adherence to laws, regulations, and standards governing the operations of call centers. It encompasses various aspects, including data protection, consumer rights, and ethical practices. Compliance is essential for maintaining customer trust, avoiding legal liabilities, and upholding the reputation of the business.

It involves legal, ethical, and professional standards aimed at ensuring respectful, private, and fair interactions with customers and employees alike. Beyond mere adherence to laws such as the TCPA in the U.S. or GDPR for European interactions, it means upholding ethical principles like honesty and transparency, maintaining high service quality, and ensuring a safe, inclusive work environment. This multifaceted approach to compliance not only safeguards sensitive customer information but also fosters a culture of integrity and respect, requiring continuous commitment to understanding and implementing these comprehensive standards across all facets of call center operations.

Compliance Laws that Must Be Followed by Call Centers

Call centers operate within a regulatory framework that requires adherence to specific laws and regulations. Some of the key regulations include:

TCPA Regulations:

The Telephone Consumer Protection Act (TCPA) regulates telemarketing activities and requires adherence to rules regarding consent, caller identification, and the National Do Not Call Registry.

The Telephone Consumer Protection Act (TCPA) of 1991 addresses consumer concerns over unsolicited telemarketing communications by setting strict guidelines on the use of automated dialing systems, prerecorded messages, SMS texts, and faxes. It mandates prior express consent for such communications, upholds a National Do Not Call Registry, enforces call timing restrictions, and requires telemarketers to provide identification and opt-out options during calls. Governed by the Federal Communications Commission (FCC), the TCPA allows for significant fines and legal actions against violators, ensuring businesses balance their marketing practices with consumers’ privacy and preferences, with its provisions evolving through FCC rulings and judicial interpretations to adapt to technological advancements and changing marketing strategies.

HIPAA Regulations:

In the U.S., call centers that handle patient information on behalf of healthcare providers and organizations are obligated to comply with the Health Insurance Portability and Accountability Act (HIPAA) that sets standards for the security and privacy of sensitive patient health information.

The Health Insurance Portability and Accountability Act (HIPAA), enacted in 1996, fundamentally shapes the U.S. healthcare landscape by enhancing health insurance continuity, reducing fraud, promoting medical savings, and improving access to long-term care. Its cornerstone, the Privacy Rule, safeguards personal health information, mandating healthcare entities to uphold confidentiality while facilitating essential healthcare services. Additionally, the Security Rule addresses the protection of electronic health data. Amendments, including the 2009 HITECH Act, have strengthened HIPAA, introducing stringent compliance measures and penalties for violations, underscoring the act’s pivotal role in balancing patient privacy with the operational needs of the healthcare system.

Standards Call Centers Must Follow

In addition to specific regulations, call centers should adhere to industry standards and best practices, here are 10 of the most important standards any call center should follow:

In addition to specific regulations, call centers should adhere to industry standards and best practices, here are 10 of the most important standards any call center should follow:

1. Recorded Call and Monitoring Consent

Recording calls is an integral part of many call center operations, facilitating quality assurance and compliance monitoring. However, before initiating call recording, it’s crucial for call centers to obtain consent from both parties involved in the conversation. This requirement is mandated by various state and federal laws, including the Telephone Consumer Protection Act (TCPA). Failure to notify consumers about call recording can lead to severe legal consequences.

2. DNC Registry

The Do Not Call (DNC) registry offers consumers a means to control the unsolicited calls they receive. Call centers are prohibited from contacting numbers listed on the DNC registry, and violating this regulation can result in substantial fines. To adhere to DNC regulations, call centers must regularly scrub their contact lists against the national DNC registry and maintain internal DNC lists. By implementing robust DNC compliance measures, call centers demonstrate respect for consumer preferences and avoid regulatory penalties.

3. HIPAA Training:

Call centers often handle sensitive health information when interacting with consumers, particularly in healthcare-related industries. Compliance with the Health Insurance Portability and Accountability Act (HIPAA) is paramount to safeguarding the privacy and security of patient data. Legal call centers should ensure that all agents receive comprehensive HIPAA training and certification. By educating agents on HIPAA regulations and best practices for handling health information, call centers mitigate the risk of HIPAA violations and maintain compliance with healthcare privacy laws.

4. PCI DSS:

For call centers involved in processing payment card transactions, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is essential to prevent data breaches and protect customers’ financial information. PCI DSS outlines requirements for securely handling and storing payment card data, including encryption, access control, and regular security assessments. Call centers must implement robust PCI DSS compliance measures to minimize the risk of data breaches and ensure the security of payment card information.

5. The Dodd-Frank Act:

The Dodd-Frank Act imposes regulations on financial institutions to promote transparency, accountability, and consumer protection in the financial services industry. Call centers operating in the financial sector must adhere to various provisions of the Dodd-Frank Act, such as those related to fair lending practices, consumer disclosures, and anti-discrimination policies. Compliance with the Dodd-Frank Act helps call centers maintain ethical standards and build trust with consumers.

6. Gramm-Leach-Bliley Act:

The Gramm-Leach-Bliley Act (GLBA) mandates financial institutions to protect the privacy and security of consumers’ personal financial information. Call centers that handle financial data must comply with GLBA requirements, which include implementing data security measures, providing privacy notices to customers, and restricting the sharing of nonpublic personal information. Adhering to GLBA regulations ensures that call centers uphold the confidentiality and integrity of financial data and mitigate the risk of identity theft and fraud.

7. Fair Debt Collection Practice:

The Fair Debt Collection Practices Act (FDCPA) regulates the actions of third-party debt collectors and ensures fair, ethical, and non-abusive practices in debt collection. Call centers engaged in debt collection activities must comply with FDCPA requirements, which prohibit harassment, deception, and unfair practices in debt collection. Adherence to FDCPA guidelines helps call centers maintain compliance with debt collection laws and protect consumers from abusive debt collection practices.

8. Sarbanes-Oxley Act:

The Sarbanes-Oxley Act (SOX) imposes regulations on publicly traded companies to enhance corporate governance, financial reporting, and accountability. Call centers that provide services to publicly traded companies or handle financial data may be subject to SOX compliance requirements. These requirements include internal controls, financial reporting transparency, and whistleblower protection. By adhering to SOX regulations, call centers contribute to maintaining integrity and trust in financial markets.

9. Equal Credit Opportunity Act:

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in credit transactions based on race, color, religion, national origin, sex, marital status, age, or receipt of public assistance. Call centers involved in credit-related activities must comply with ECOA regulations, which mandate fair and nondiscriminatory practices in credit decision-making and customer interactions. Adherence to ECOA requirements ensures that call centers promote equal access to credit and prevent discriminatory practices in lending.

10. Truth in Lending Act:

The Truth in Lending Act (TILA) requires lenders to disclose key terms and costs of credit agreements to consumers, enabling them to make informed decisions about borrowing. Call centers engaged in consumer lending activities must adhere to TILA regulations, which include providing accurate and transparent disclosures of loan terms, interest rates, and fees. Compliance with TILA helps call centers maintain transparency and fairness in consumer lending practices and fosters trust with borrowers.

By adhering to these standards and regulations, call centers demonstrate their commitment to ethical conduct, consumer protection, and regulatory compliance. Implementing compliance measures not only helps call centers avoid legal liabilities and penalties but also fosters trust and confidence among consumers and stakeholders.

Common Call Center Compliance Mistakes

Despite the importance of compliance, call centers often make mistakes that can have serious consequences. Some common errors include:

- Recording Conversations without Agent or Customer Consent: Failing to obtain consent before recording calls violates privacy laws and can lead to legal repercussions.

- Recording and Storing Payment Information in the Wrong Way: Mishandling payment card information can result in data breaches and expose customers to fraud, leading to regulatory penalties and loss of trust.

- Contacting Numbers in the DNC List: Ignoring the National Do Not Call Registry can lead to complaints, fines, and damage to the company’s reputation.

- Ignoring Customer Requests to Opt-Out: Not respecting or efficiently processing customer requests to cease communication is not only a breach of trust but also a direct violation of regulations like the TCPA.

- Overlooking State-Specific Regulations: Call centers operating in multiple jurisdictions may inadvertently overlook state-specific laws and regulations, leading to non-compliance issues due to varying legal requirements.

- Ineffective Compliance Management Systems: Lack of a robust system to manage and monitor compliance can result in systemic failures, where non-compliant practices become widespread due to inadequate oversight and corrective measures.

- Neglecting Regular Compliance Audits: The absence of regular audits to assess and ensure compliance with laws and internal policies can allow non-compliant practices to persist unchecked

- Inadequate Training: Call center agents may not be adequately trained on compliance issues, leading to mistakes in handling customer data, making unauthorized calls or messages, and not following proper protocols for customer interaction.

Impact of Non-compliance in Contact Centers

Non-compliance with regulatory requirements can have far-reaching consequences for call centers, including:

Non-compliance with regulatory requirements can have far-reaching consequences for call centers, including:

- Penalties, Fines, and Legal Actions: Regulatory authorities can impose significant fines and penalties for violations, leading to financial losses for the business.

- Negative Publicity and Reputational Damage: Non-compliance can tarnish the company’s reputation, eroding customer trust and loyalty.

- Increased Customer Dissatisfaction: Violating consumer rights and privacy can result in dissatisfaction and complaints from customers, harming the overall customer experience.

- Loss of Customer Trust and Loyalty: Non-compliance undermines trust and loyalty by signaling a disregard for ethical standards and customer rights, prompting customers to seek more trustworthy alternatives.

- Call Center Operations Halted: Regulatory violations can lead to call center shutdowns, causing revenue loss, business disruption, and morale issues among employees.

Call Quality Assurance and Ongoing Training

Maintaining and improving quality assurance and providing ongoing training are essential components of effective call center management. By implementing best practices, call centers can maintain compliance, improve service quality, and enhance overall performance.

Call Center Monitoring:

Real-time call center monitoring allows supervisors to oversee agent performance, ensure compliance with regulations, and provide immediate feedback. Tools such as Unified Agent Desktop facilitate comprehensive monitoring of call center activities.

Developing a Compliance Policy:

Establishing a robust compliance policy is crucial for guiding employees on legal requirements, ethical standards, and best practices. A well-defined policy outlines expectations, procedures, and consequences for non-compliance, promoting adherence to regulations.

Providing Ongoing Agent Training:

Continuous training equips agents with updated knowledge, skills, and techniques necessary for delivering exceptional customer service and maintaining compliance. Regular training sessions address regulatory changes, customer handling techniques, and compliance protocols.

Utilizing Call Center Scripts:

Call center scripts serve as valuable tools for ensuring consistency in communication, adherence to compliance guidelines, and accurate information dissemination. Well-crafted scripts help agents navigate conversations effectively while maintaining compliance with regulatory requirements.

Using Compliant Call Center Software

Employing compliant call center software, such as Omni+, enhances operational efficiency and regulatory compliance. Omni+ offers features like automatic speech recognition and text-to-speech capabilities, streamlining call management and monitoring processes.

Leveraging AI Speech Analytics Tools:

AI-powered speech analytics tools enable call centers to analyze and interpret customer interactions, identify compliance risks, and improve agent performance. Solutions like Call Center Speech Analytics automate the monitoring process, ensuring regulatory compliance and enhancing service quality.

Ensuring Regular Compliance Monitoring:

Regular compliance monitoring involves conducting audits, assessments, and evaluations to identify areas of non-compliance and implement corrective measures promptly. Monitoring activities ensure ongoing adherence to regulations and mitigate compliance risks effectively.

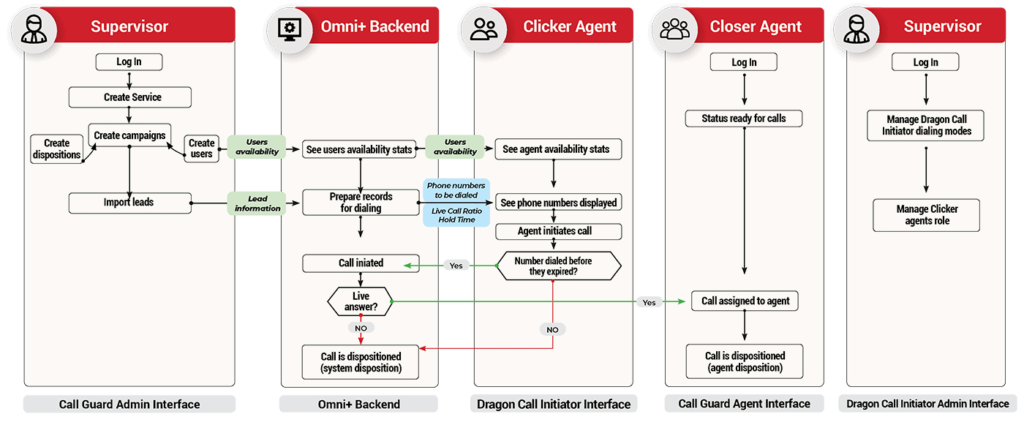

NobelBiz Omni+ Call Guard Ecosystem

The NobelBiz Omni+ Call Guard Ecosystem offers comprehensive dialing capabilities that help increase outbound call volumes in both consent and non-consent scenarios while mitigating TCPA compliance risk.

The NobelBiz Omni+ Call Guard Ecosystem offers comprehensive dialing capabilities that help increase outbound call volumes in both consent and non-consent scenarios while mitigating TCPA compliance risk.

By offering various dialing methods, the Call Guard Ecosystem can be successfully deployed in multiple scenarios becoming increasingly popular (and even necessary) in Collections, Telemarketing, Lead generation, and so on.

Call center compliance is a multifaceted challenge that requires careful attention to laws, regulations, and best practices. By prioritizing compliance, call centers can protect their reputation, mitigate risks, and enhance customer trust. Implementing robust compliance policies, investing in training and technology, and fostering a culture of compliance are essential steps towards ensuring regulatory adherence and long-term success in the call center industry.

Brayan Carpio

“The technology aspect of NobelBiz stood out compared to the competition, and also the great team! All the way from onboarding to support to troubleshooting has been great throughout this journey!”

How NobelBiz Omni+ can take your Contact Center to the Next Level?

With NobelBiz Omni+ you don’t just make or take calls. You can use a sophisticated outbound dialing engine that increases your response rates, record calls to create an extensive customer history database, and move your interactions on multiple channels to cover a larger array of customer needs and demands; all while using personalized and customized scripts.

NobelBiz Omni+ is a true omnichannel contact center software solution that allows you to capture customer information, increase KPIs and maintain ASL. Seamlessly integrate proprietary or third-party CRM applications with our extensive APIs and data dictionary libraries.

Michael McGuire is a contact center industry expert with almost two decades of experience in the space. His experience includes roles as Director of Contact Center Digital Transformation at NobelBiz, and as Director of Operations at FLS Connect, managing multiple call centers. As President of Anomaly Squared and Targeted Metrics, Michael successfully transitioned companies into remote operations and significantly boosted revenues. With a strong background in customer service, leadership, strategic planning, and operations management, Michael excels in driving growth and innovation in the call center space.

Mike is also a proud Board Member for R.E.A.C.H Trade Group, promoting consumer protection and satisfaction and Co-host of the Off Skripted Podcast – a show about Life, Call Centers and everything in between.